What if the very tokens you fear are the secret engines powering the most trusted DeFi analytics platform? DexScreener’s explosive growth, fueled by millions of users and sky-high revenues, thrives amid controversy—promoting scam tokens while building a technological fortress few rivals can breach. This contradicts every instinct about trust and reliability in cryptocurrency markets. Yet, beneath the surface lies a layered ecosystem where ethical ambiguity, user psychology, and cutting-edge blockchain indexing collide to shape the future of decentralized trading analytics. Unlocking this secret reveals not only how to navigate crypto’s wild west but also how to harness its chaos for smarter trading and investment strategies.

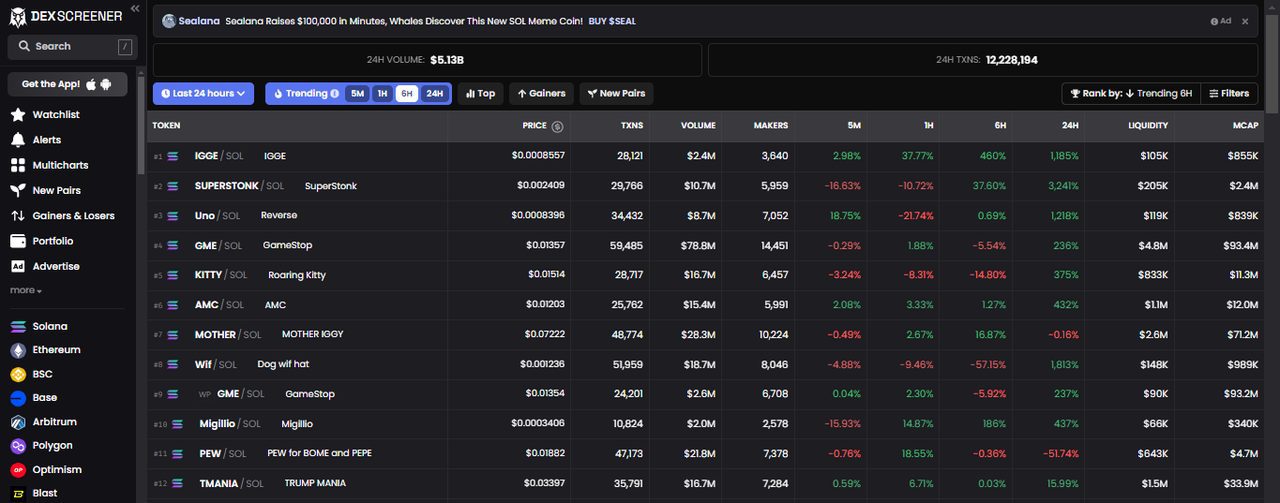

Conventional wisdom says scam tokens erode confidence and should be ruthlessly excluded from platforms claiming authority. DexScreener, however, flips this logic on its head. Despite widespread industry criticism—including from Coinbase’s Head of Product Operations accusing it of “dark patterns” that promote fraudulent tokens—the platform’s user base keeps surging, hitting 1.5 million monthly active users and generating estimated daily revenues between $150,000 and $250,000. How? The paradox is that the very presence of scam tokens, boosted through paid listings and aggressive advertising, creates a liquidity heatmap for speculative traders chasing early demand signals. This dynamic amplifies trading volume and volatility, which in turn attracts more eyeballs eager for real-time on-chain analytics. Rather than shunning chaos, DexScreener monetizes it, turning an ethical risk into a unique growth lever.

This reveals a systemic tension: user trust in the platform’s data and charts coexists uneasily with growing reputational risk. Traders crave transparency but also rely on the platform’s trending algorithms and whale tracking to spot FOMO waves and anticipate flash-loan arbitrage moves. Scam tokens, despite their dubious nature, become catalysts for behavioral alpha—profit opportunities born from collective irrationality and bounded rationality biases, such as anchoring and loss aversion. DexScreener’s proprietary blockchain indexer, which parses raw logs across 80+ networks without intermediaries, ensures data accuracy that traders rely on to navigate these treacherous waters.

How can a decentralized analytics platform with fewer than ten employees handle millions of users while generating over $50 million annually? The answer lies in a paradoxical business model that blends free core services with a lucrative token advertising ecosystem. Basic functionalities—real-time price tracking, multi-chart displays, and portfolio monitoring—are free, lowering the barrier for trader onboarding and encouraging habitual use. Meanwhile, token projects pay hundreds of dollars to list, boost visibility, and run premium ad campaigns, some exceeding $100,000. This “freemium paradox” exploits the crypto attention economy, where visibility often trumps fundamentals.

Traders, especially those seeking yield farming or cross-DEX arbitrage opportunities, find themselves glued to DexScreener’s platform, driven by alerts, webhook integrations, and Telegram trading bots that signal early demand and whale moves. The platform’s integration with TradingView’s Supercharts further deepens user engagement by enabling sophisticated technical analysis without leaving the ecosystem. This synergy of free access and paid promotion creates a feedback loop: traders chase trends launched by paid boosts, which generate volume and volatility, attracting more premium advertising spend—a virtuous yet volatile cycle.

For those eager to go deeper with DexScreener, the platform’s unique multi-chain coverage and real-time data feed open unprecedented windows into cross-chain swaps, impermanent loss hedging, and MEV analysis. Here, behavioral heuristics like regret minimization and FUD neutralization become essential cognitive tools for surviving and thriving.

Behind the splashy front page is a quietly revolutionary technology engine. DexScreener’s proprietary blockchain indexer, operating without reliance on external APIs, processes millions of raw blockchain logs every few seconds across over 80 Layer 1 and Layer 2 networks—including Ethereum, Solana, BNB Chain, and Polygon. This microservices architecture supports near real-time updates, delivering unparalleled data freshness and accuracy. The small, remote-first team leverages automation to scale efficiently, achieving a staggering revenue-to-employee ratio of approximately $25-31 million per person.

This operational efficiency creates a formidable competitive moat. While rivals like DEXTools and GeckoTerminal compete on traffic and features, none match DexScreener’s breadth of blockchain coverage or data directness. Their technical moat is complemented by network effects: as more token projects list and advertise, more traders join, generating more data and liquidity, reinforcing the platform’s dominance. Yet, this triumph is shadowed by reputational fragility. The platform’s reliance on paid promotions of questionable tokens invites regulatory scrutiny and risks user trust erosion, posing a classic prisoner’s dilemma for sustained growth.

At the intersection of on-chain analytics and behavioral finance lies a fertile ground for innovation. DexScreener’s customizable alerts, whale tracking, and trending algorithms act as cognitive nudges that mitigate trader biases like overtrading and anchoring bias. Their portfolio stress tests and risk maps help users manage volatility versus liquidity trade-offs, while gas-fee optimization features reduce friction costs. This behavioral coaching dimension transforms a purely data-driven tool into a decision support system that respects bounded rationality and cognitive overload challenges.

Moreover, the platform’s multi-chart correlation and slippage protection tools enable sophisticated cross-DEX arbitrage and MEV-aware strategies, traditionally reserved for institutional players. By democratizing access to these insights, DexScreener reshapes the crypto trader’s mental model—turning what was once chaotic noise into structured signals. This evolution parallels the “behavioral alpha” concept, where understanding crowd psychology and reflexivity loops becomes as critical as technical analysis.

DexScreener embodies a profound paradox: it is simultaneously a beacon of transparency and a magnet for market manipulation; a lean startup and a multi-million dollar powerhouse; a technological innovator and a reputational lightning rod. This duality reflects broader trends in decentralized finance, where innovation and risk are inseparable. The platform’s success underscores that in the crypto realm, embracing complexity and ethical ambiguity can unlock unprecedented value—if navigated with savvy and vigilance.

For traders and token issuers alike, the lesson is clear: mastering DeFi requires more than raw data—it demands fluency in behavioral dynamics, technological nuance, and regulatory foresight. DexScreener is not just a tool but a microcosm of the crypto ecosystem’s evolving psyche and infrastructure, offering a front-row seat to the future of decentralized exchange analytics.

It’s both. While promoting questionable tokens risks user trust and invites regulatory scrutiny, it also fuels liquidity and volatility that attract speculative traders relying on real-time analytics. This creates a tension between ethical responsibility and business survival, reflecting a broader DeFi paradox where chaos is a source of opportunity.

Yes, thanks to a highly automated proprietary blockchain indexer and microservices architecture that process raw blockchain data without external APIs. This lean operational model yields extraordinary scalability and efficiency, enabling top-tier service with minimal personnel.

Behavioral finance tools integrated into DexScreener—such as whale tracking, cognitive nudges, and risk maps—help traders mitigate biases like overtrading and loss aversion. They turn complex on-chain data into actionable insights aligned with human decision-making patterns, enhancing profit potential while reducing emotional mistakes.

Leave a Reply