Stop. Reread that. The very platforms hailed as beacons of transparency in decentralized finance might be the unwitting catalysts of deception. It sounds paradoxical: tools designed to empower traders and projects are accused of enabling scam tokens to flourish. Yet beneath the surface of soaring traffic and skyrocketing revenues lies a complicated web of incentives, technical mastery, and ethical ambiguity. Could it be that the most trusted analytics platforms are caught in a Freemium Paradox—giving away free insights while profiting handsomely from the very tokens they should be scrutinizing? The answer reshapes how we understand trust, risk, and opportunity in crypto trading today.

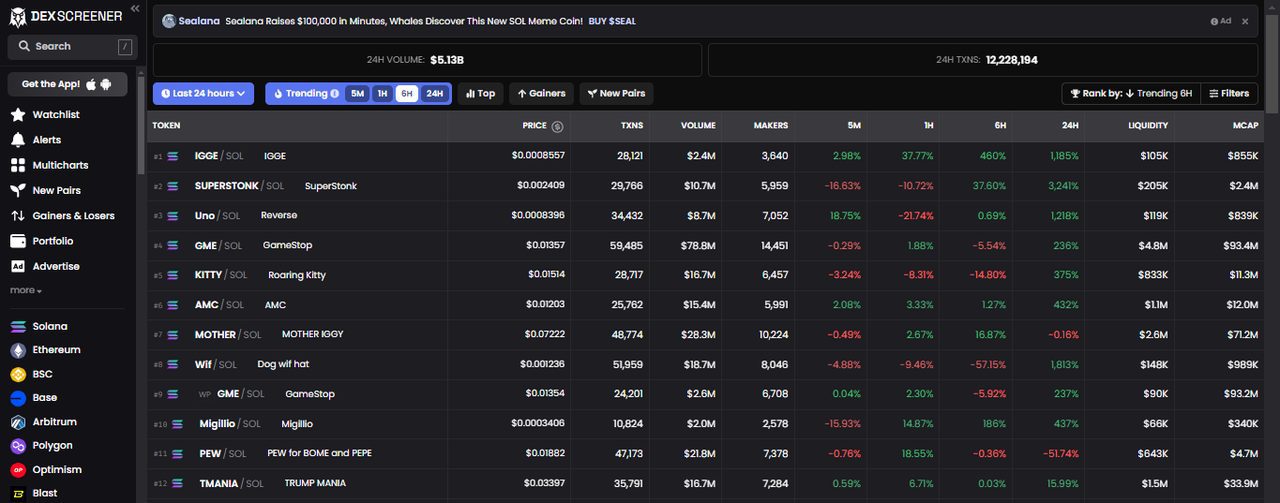

DEX Screener, with over 1.5 million monthly users and 12 million visits, is celebrated for its real-time analytics across 80+ blockchains. Its proprietary blockchain indexer parses raw data without intermediaries, offering unparalleled speed and depth. Yet, behind this technical marvel lies a business model that monetizes token listings at $300 each, with premium boosts costing up to six figures. This creates a perverse incentive structure where scam tokens pay to stand out, turning a platform of clarity into a billboard for deception. The paradox? Users flock to DEX Screener for transparency, unaware that the front page may be curated less by merit and more by payment. The so-called “dark patterns” criticized by industry leaders like Coinbase’s Conor Grogan expose how the Freemium Paradox weaponizes user trust for profit.

This phenomenon is not just a glitch—it’s systemic. The high revenue-to-employee ratio ($25-31 million annually per staffer) hints at automation’s double-edged sword: while scaling user access, it also scales reputational risk. In a market where over $200 million annually may derive from paid scam token promotion, the “free” experience is anything but neutral. The Freemium Paradox reframes transparency as a spectrum, not a binary. It challenges traders to rethink where and how they place their trust.

At first glance, DEX Screener’s explosive growth—39.94% traffic increase in May 2025 alone—signals success. Yet deeper analysis reveals a counterintuitive insight: the platform’s vast user base and multi-chain coverage become a double-edged sword in combating fraud. The more blockchains and tokens integrated, the harder it is to police listings effectively. This scalability paradox means that while DEX Screener’s technology is a moat against competitors, it also creates fertile ground for bad actors exploiting listing fees and boosting packages.

Here’s the twist: the very network effects that attract legitimate traders also amplify the visibility of scam tokens, creating a feedback loop of attention and risk. This dynamic is compounded by behavioral biases prevalent among retail traders—anchoring on trending tokens, FOMO-driven rushes, and overtrading based on social proof—heightening vulnerability. Thus, the success of platforms like DEX Screener inadvertently fuels a behavioral ecosystem where scam tokens thrive under the guise of legitimacy.

Understanding this interplay is key to navigating the crypto landscape. It explains why even sophisticated traders experience loss aversion and regret minimization failures despite access to advanced analytics. The network effect, often hailed as a growth engine, becomes a risk amplifier without nuanced user education and robust moderation.

DEX Screener’s proprietary blockchain indexer is a technical tour de force, parsing millions of transactions across 80 networks in real-time without relying on external APIs. This microservices architecture supports rapid updates every few seconds, a feature few competitors can match. The integration with TradingView brings institutional-grade charting and analytics directly to retail traders, democratizing access to professional tools.

Yet, this technological moat is juxtaposed against ethical headwinds. The company’s dependence on listing fees and promotional payments creates a business model vulnerable to regulatory scrutiny and reputational damage. Despite disclaimers and content moderation efforts, user complaints and a low Trustpilot rating (1.8 stars) underscore dissatisfaction with scam token promotion and customer support.

This tension manifests as a “Transparency Trap”: the platform’s openness invites scrutiny and trust but also exposes it to exploitation by malicious actors and critics alike. The trap challenges platforms to evolve beyond pure technology and embrace governance frameworks that balance growth, user protection, and ethical responsibility.

For traders, recognizing the Transparency Trap means adopting a skeptical lens—even when armed with the best tools. It calls for behavioral coaching bots, nudge design, and enhanced risk maps to counter cognitive overload and FUD, transforming analytics from raw data into actionable wisdom.

In a market saturated with information asymmetry and choice overload, the old paradigm of “trust the platform” no longer suffices. Platforms like DEX Screener must innovate not only technologically but psychologically—integrating behavioral KPIs, urgency effects, and clarity framing to guide users toward sound decision-making.

Consider “behavioral alpha”: the excess return generated by mastering one’s own cognitive biases and emotional impulses using advanced analytics and personalized nudges. DEX Screener’s rich data sets, combined with tools like automated price alerts, whale tracking, and social sentiment feeds, create the raw ingredients for behavioral alpha—but only if users are equipped to interpret signals correctly.

This shifts the role of analytics platforms from mere data providers to behavioral coaches. It’s a paradigm shift from passive observation to active engagement, blending on-chain analytics with psychology to reduce regret, prevent overtrading, and optimize risk budgeting. The future of crypto trading lies in this synthesis, where technology meets human insight.

For those who seek to profit and protect their capital, embracing this new model is non-negotiable. To go here and harness DEX Screener’s full power is to step into the next generation of crypto trading—one that demands savvy, skepticism, and strategic behavioral design.

Yes, paradoxically. While free access democratizes data, it also exposes users to a flood of paid listings, including scam tokens promoted aggressively via boosts and advertising. Without critical filtering and behavioral coaching, traders may anchor on these tokens’ visibility rather than their fundamentals, increasing vulnerability.

Unlikely. The dependence on listing fees and premium campaigns inherently biases content curation toward paying projects. This creates ethical and regulatory tensions that can only be mitigated, not eliminated, by transparency and user education. Traders must layer their due diligence beyond platform listings.

Start by integrating automated alerts, whale tracking, and social sentiment feeds while consciously applying behavioral insights—such as recognizing FOMO, anchoring, and loss aversion. Use personalized nudges and portfolio stress tests to manage risk actively. Ultimately, treat analytics as a behavioral coach, not a crystal ball.

Leave a Reply